Canada Handbook of Last Will & Testament 2006-2026 free printable template

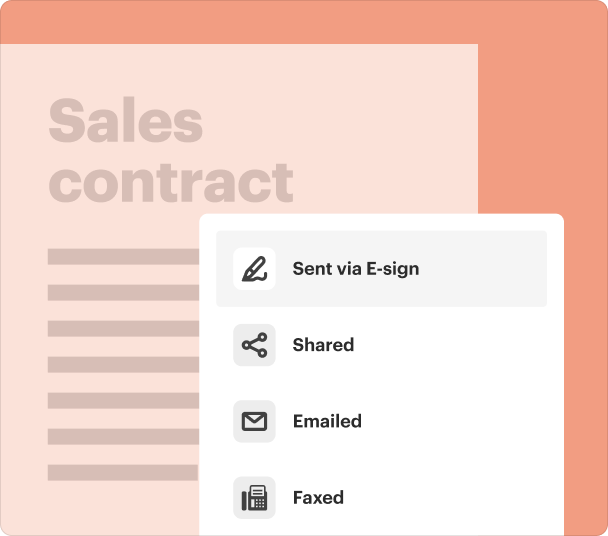

Fill out, sign, and share forms from a single PDF platform

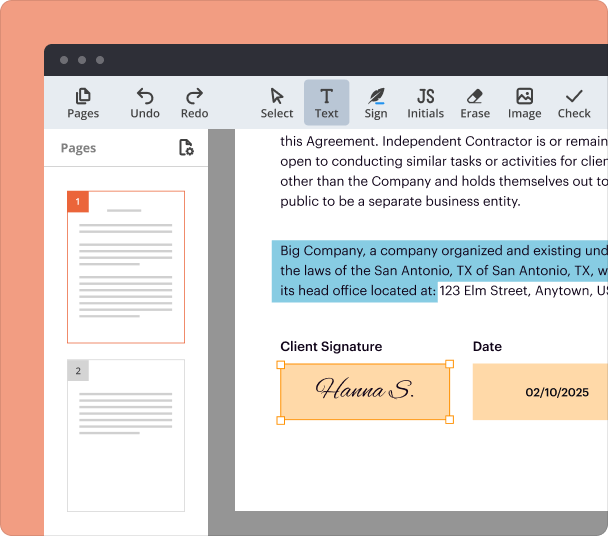

Edit and sign in one place

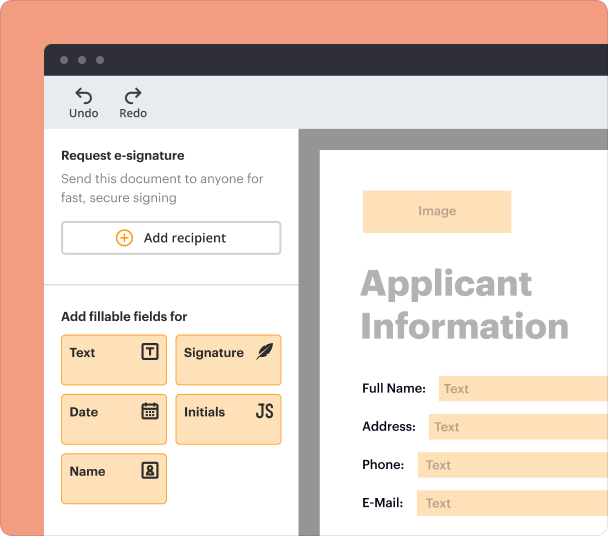

Create professional forms

Simplify data collection

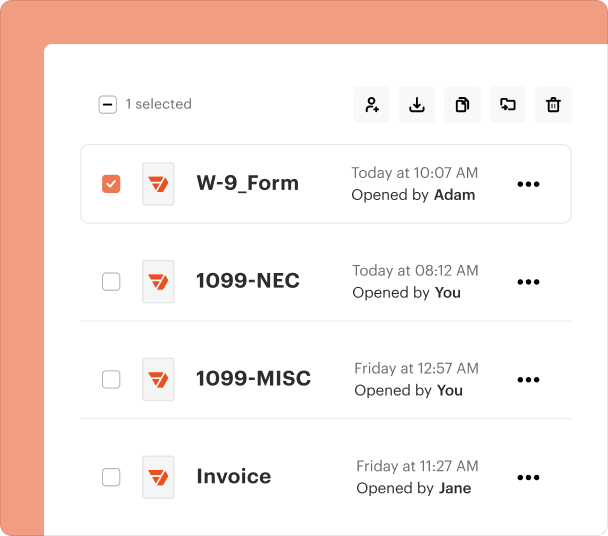

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the Canada Handbook of Last Form

Overview of the Canada Handbook of Last Form

The Canada Handbook of Last Form is a legal document designed to outline an individual's final wishes regarding the distribution of their assets after death. It serves as a formal request to ensure that one's intentions are respected and legally recognized. This handbook encompasses various aspects including bequests to family members, friends, and charitable organizations.

Key Features of the Canada Handbook of Last Form

This legal form offers several essential features, such as:

-

The form provides clear spaces for detailed instructions about the distribution of personal property.

-

Once completed and signed, it becomes a legally enforceable document.

-

Users can modify bequests and personal wishes according to their circumstances.

Who Needs the Canada Handbook of Last Form

This handbook is essential for any adult in the United States who wishes to specify how their estate should be handled after their passing. It is particularly important for individuals with significant assets, dependents, or those with specific wishes regarding funeral arrangements.

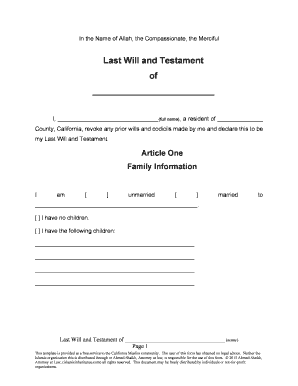

How to Complete the Canada Handbook of Last Form

Filling out the Canada Handbook of Last Form involves several straightforward steps:

-

Collect details about beneficiaries, asset valuations, and any specific directives you want to include.

-

Fill in the required fields clearly and accurately to avoid confusion.

-

Ensure that the form is signed in the presence of witnesses as required by law.

Best Practices for Accurate Completion

To ensure that your Canada Handbook of Last Form is completed accurately, consider the following best practices:

-

Understand any specific estate laws that may affect your will.

-

Consult with a legal professional to ensure the document meets all legal requirements.

-

Make multiple copies and store them in secure locations.

Common Errors to Avoid

Common mistakes when filling out the Canada Handbook of Last Form can lead to complications. Be aware of:

-

Leaving out beneficiaries or specific asset details can create confusion.

-

Ensure all signatures are present, as these are critical for legality.

-

Regularly update the form to reflect any life changes, such as marriage or the birth of a child.

Frequently Asked Questions about form legal

What is the purpose of the Canada Handbook of Last Form?

The form is used to outline an individual's final wishes regarding asset distribution after their death.

Is it necessary to consult a lawyer when completing the form?

While not required, seeking legal advice can help ensure the form meets all relevant laws and accurately reflects your intentions.

pdfFiller scores top ratings on review platforms